Imagine your credit score as a garden. Just as a well-tended garden flourishes, a nurtured credit score can open doors to financial opportunities. In this guide, we’ll explore the art of cultivating your credit score, ensuring it grows and thrives.

Chapter 1: Understanding Your Credit Soil

Before planting seeds in your garden, you understand the soil. Similarly, knowing the basics of your credit score is crucial. It’s composed of several elements: payment history, credit utilization, length of credit history, new credit, and credit mix.

“Your credit score is like a financial fingerprint, unique and telling.”

Chapter 2: Planting the Seeds – Building a Solid Foundation

To grow a garden, you start with healthy seeds; for your credit, it’s about building a solid foundation. If you’re starting from scratch, consider a secured credit card or becoming an authorized user on a family member’s account. Regular, on-time payments are like watering your garden – essential for growth.

“Timely payments: the regular rhythm that nurtures your credit score.”

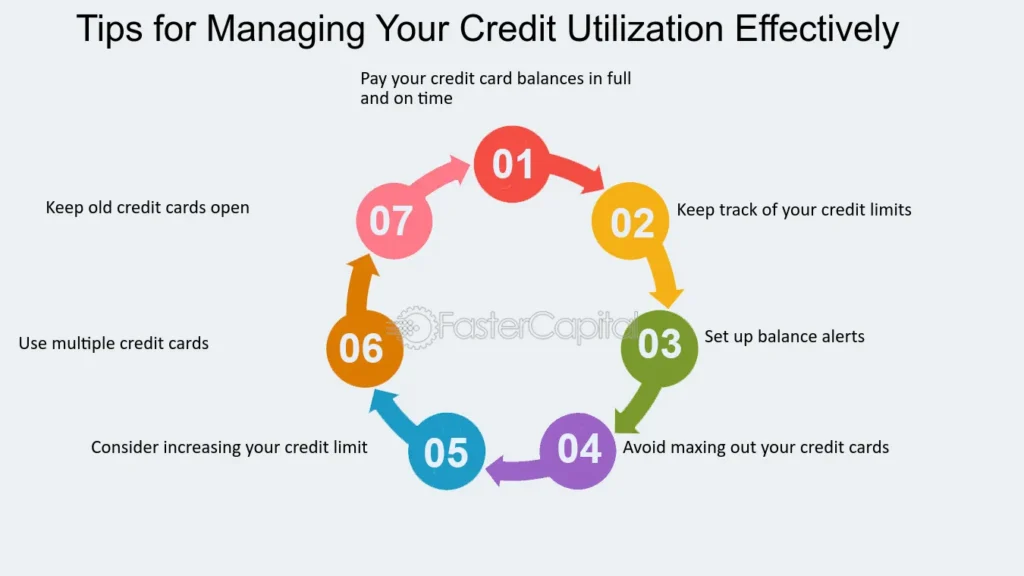

Chapter 3: Pruning and Maintenance – Managing Your Credit Utilization

Pruning is vital in a garden; similarly, keeping your credit utilization low is key. Aim to use less than 30% of your available credit. It’s like giving your plants enough space to grow without overcrowding.

Chapter 4: Diversifying Your Garden – A Mix of Credit Types

Just as a diverse garden is more resilient, a mix of credit types can strengthen your credit score. A healthy mix might include a mortgage, auto loan, and a couple of credit cards. It shows lenders you can handle different types of credit responsibly.

Engage with the reader: Have you ever thought about how your credit mix reflects your financial responsibility?

Chapter 5: Longevity and Patience – The Age of Your Credit History

In gardening, patience is a virtue. The same goes for your credit history. The longer your credit history, the better it is for your score. It’s like a mature garden; it shows stability and long-term care.

Chapter 6: Avoiding Pests – Regular Monitoring and Dispute of Errors

Regularly check your credit report for inaccuracies, much like keeping an eye out for pests in a garden. Dispute any errors you find. Maintaining accuracy is crucial for a healthy credit score.

Chapter 7: Growth Through Knowledge – Educating Yourself

Finally, educate yourself on financial matters. Staying informed is like knowing the best practices for gardening. Our website offers a plethora of resources to help you on this journey.

Thought-provoking statement: Just as a gardener learns from each season, what can your credit history teach you about your financial habits?

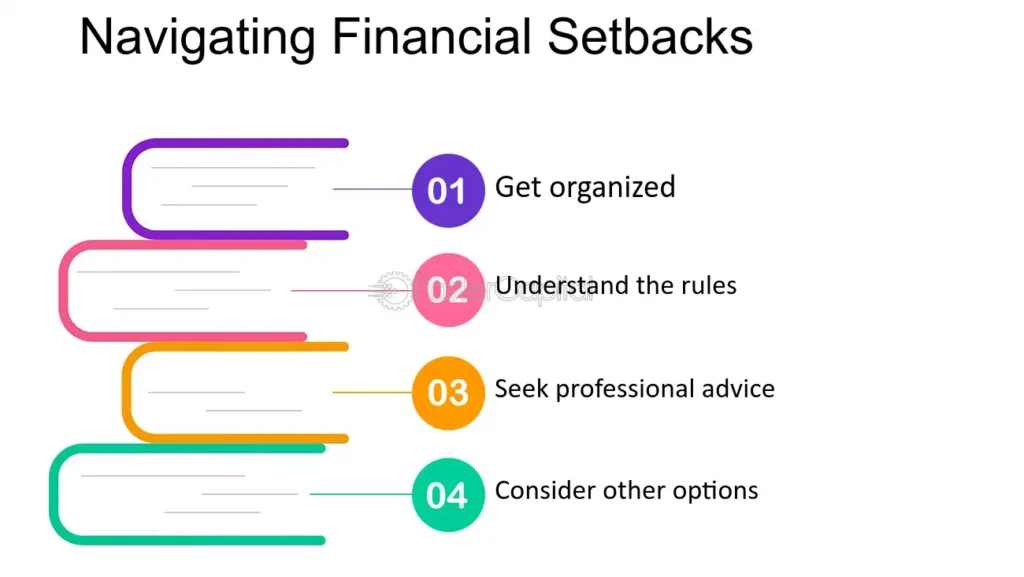

Chapter 8: Navigating the Seasons – Dealing with Financial Setbacks

Much like a garden facing unexpected weather, your credit score may confront challenges. Financial setbacks like late payments or defaults are akin to a harsh season. The key is not to despair but to take corrective actions. Begin by addressing any outstanding debts and negotiate with lenders if necessary. Remember, after every winter, spring brings renewal.

Engaging Question: Have you ever faced a financial storm and how did you navigate through it?

Chapter 9: Fertilizing Your Score – Smart Credit Inquiries

Just as you would cautiously choose the right fertilizer for your plants, be selective about credit inquiries. Hard inquiries, like applying for new credit, can temporarily lower your score. It’s important to apply for new credit sparingly and strategically, ensuring it serves your overall financial growth.

Chapter 10: The Art of Balance – Juggling Multiple Accounts

Managing multiple credit accounts is like tending to different plants in your garden. Each requires attention but in varying amounts. Pay off high-interest debts first while maintaining minimum payments on others. This balance is crucial for a thriving credit landscape.

“Balance in credit, as in nature, is not a state of stillness but a dynamic equilibrium.”

Chapter 11: Harvesting Rewards – Benefits of a Good Credit Score

A well-maintained garden yields a bountiful harvest. Similarly, a good credit score offers numerous benefits: lower interest rates, better loan terms, and easier approval for rental houses and jobs. It’s the fruitful reward for your diligent credit cultivation.

Rhetorical Question: Imagine the doors that could open with a higher credit score; what opportunities would you seize?

Chapter 12: The Wisdom of the Gardener – Learning from Mistakes

Every gardener makes mistakes, but the wise ones learn and grow from them. Similarly, your credit journey may have its share of missteps. Reflect on them, learn, and use these lessons to improve your financial habits.

Thought-Provoking Idea: Consider your past credit mistakes as lessons, not failures. How have they shaped your financial wisdom?

Chapter 13: Cultivating Credit Resilience – Preparing for the Future

In the final phase of our journey, it’s crucial to think ahead. Just like a gardener prepares for the next season, you should build credit resilience. This means not only maintaining your current score but also preparing for future financial goals. Whether it’s buying a home, investing in education, or saving for retirement, your credit health plays a pivotal role.

Engaging Tip: Set clear financial goals and tailor your credit activities to align with these objectives. How does your credit strategy support your future dreams?

Chapter 14: The Organic Approach – Avoiding Quick Fixes

In the world of credit, there are no ‘miracle-grow’ solutions. Beware of quick fixes that promise rapid improvements to your credit score. Much like sustainable gardening, building a strong credit score is a gradual process that requires consistency and integrity.

“True growth, whether in a garden or your credit score, takes time and honest effort.”

Chapter 15: The Richness of Diversity – Using Different Credit Tools

Diversity enriches a garden, and similarly, using a variety of credit tools can enhance your credit profile. This doesn’t mean opening numerous accounts hastily but strategically utilizing different types of credit. Consider installment loans, revolving credit, and perhaps a personal line of credit, each used responsibly and within your means.

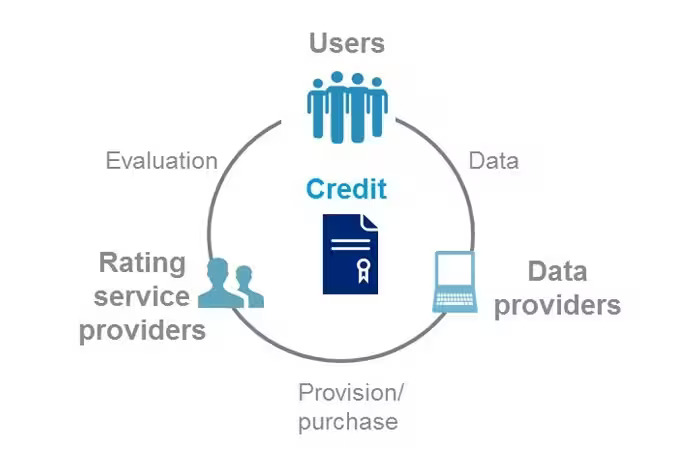

Chapter 16: The Credit Ecosystem – Understanding External Factors

Your credit score doesn’t exist in isolation; it’s part of a broader financial ecosystem. Economic factors, interest rates, and industry trends can all influence your credit health. Staying informed about these external elements allows you to adapt and thrive.

Thoughtful Question: How do external economic factors influence your personal credit decisions?

Chapter 17: The Flourishing Finish – Continuous Credit Education

Finally, continuous education is the key to a flourishing credit score. Stay updated with financial news, understand new credit laws, and be aware of evolving lending practices. Your informed decisions will ensure that your credit score remains a robust and vibrant part of your financial landscape.