Imagine budgeting as a culinary adventure where you’re the master chef in your kitchen—the kitchen of finances! Just as a chef uses a recipe to create a delightful dish, you’ll use budgeting skills to cook up a healthy financial life. Welcome to Budgeting 101: Mastering Your Finances. Let’s roll up our sleeves and start cooking!

Chapter 1: The Ingredients of Your Financial Kitchen

Think of your income and expenses as the ingredients in your pantry. Some are staples, essential for your day-to-day living (like rent, groceries, and utilities), while others are the spices – the occasional indulgences that add flavor to life (like vacations or tech gadgets).

The Recipe for Success

Every successful dish starts with understanding what you have in your pantry. Begin by listing all your income sources, be it your salary, side hustles, or passive incomes. Next, categorize your expenses. There are the fixed expenses, like rent or mortgage, which are like the base ingredients of your dish. Then, you have the variable expenses, such as dining out or entertainment, which are more like the herbs and spices – nice but adjustable.

Understanding Portions: Income vs. Expenses

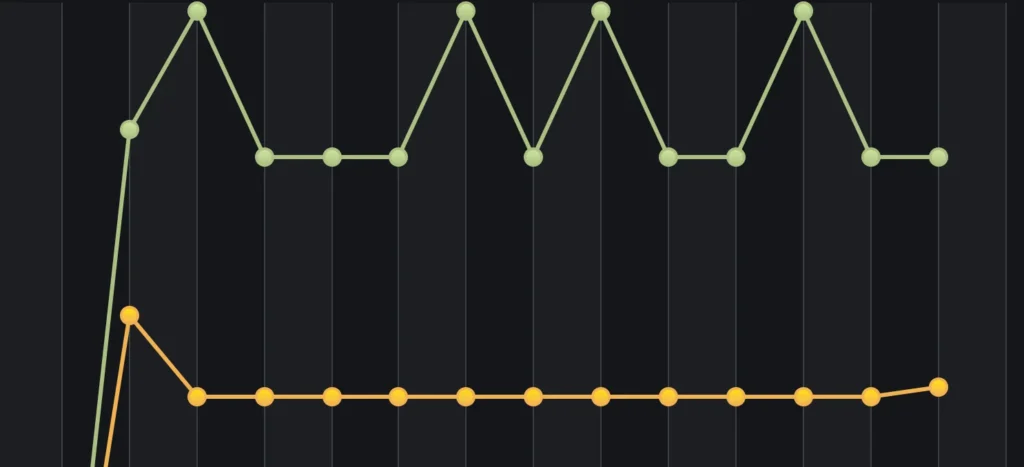

A great chef knows the importance of balancing flavors. Similarly, in budgeting, balance your income (inflow) with your expenses (outflow). If your expenses are overpowering your income, it’s time to adjust the recipe. This might mean cutting back on some of the spices (non-essential expenses) or finding ways to add more base ingredients (increasing your income).

Chapter 2: Cooking Techniques – Tools to Manage Your Finances

The Budgeting Cookbook

There are several budgeting methods, like the 50/30/20 rule – where you allocate 50% of your income to necessities, 30% to wants, and 20% to savings. It’s like choosing the right cooking method for your dish. Some prefer baking (a slow, steady approach like traditional budgeting), while others might choose sautéing (a more flexible, quick method like the zero-based budgeting).

Tech in the Kitchen: Financial Apps

Modern chefs have a variety of gadgets at their disposal. Similarly, utilize financial apps and tools to streamline your budgeting process. These tools can track your expenses, categorize them, and even offer insights into your spending habits – think of them as your digital sous-chefs!

Chapter 3: The Art of Garnishing – Saving and Investing

Savings: The Secret Sauce

Just as a garnish elevates a dish, savings elevate your financial health. Prioritize building an emergency fund – a safety net to catch you if you fall. Aim to save at least three to six months’ worth of living expenses.

Investing: Adding Flavor to Your Portfolio

Investing is like adding exotic spices to your dish. It can be risky but can also immensely enhance the flavor (or in this case, your financial growth). Whether it’s stocks, bonds, or mutual funds, start small and learn as you go. Remember, it’s about finding the right blend that suits your taste (risk tolerance) and nutritional needs (financial goals).

Chapter 4: Tasting as You Go – Monitoring Your Financial Health

Regular Check-ins: The Taste Test

In cooking, chefs often taste their dish throughout the process to ensure the flavors are coming together just right. Similarly, in budgeting, regular check-ins are crucial. Set aside time each month to review your budget. Are you overspending in certain categories? Do you need to adjust your savings goals? This is your chance to tweak your financial recipe to make sure it’s still palatable.

Financial Feedback: The Palate of the Public

Just as chefs value feedback from their diners, your financial plan can benefit from external insights. Consider consulting with a financial advisor or joining a personal finance community. These resources can offer valuable advice and perspectives, much like a seasoned chef offering tips to an apprentice.

Chapter 5: Mastering Advanced Techniques – Debt Management and Credit Scores

Debt: Managing the Heat

Think of debt as a hot stove. Handled correctly, it can be a useful tool, but if left unattended, it can cause a kitchen disaster. If you have debts, prioritize paying them off. High-interest debts, like credit card balances, are like a pot boiling over – they need immediate attention. Create a debt repayment plan that works for you, whether it’s the snowball method (paying off smaller debts first) or the avalanche method (targeting high-interest debts first).

Credit Scores: The Michelin Stars of Finance

Your credit score is akin to a restaurant’s Michelin stars. It’s a measure of your financial reliability and reputation. Maintaining a good credit score is essential, especially if you plan to apply for loans or mortgages. Pay your bills on time, keep your credit utilization low, and monitor your credit report regularly to ensure there are no inaccuracies.

Chapter 6: Plating and Presentation – Sharing Your Financial Success

The Art of Plating: Financial Transparency

In fine dining, presentation is everything. Similarly, being transparent about your financial goals and challenges with your family or partner is crucial. Share your budgeting goals and involve them in your financial planning. This approach ensures everyone at the table understands the menu (financial goals) and appreciates the effort that goes into preparing the meal (financial stability).

Financial Literacy: Sharing the Recipe

Just as chefs might share their recipes, don’t hesitate to share your financial knowledge with others. Whether it’s advising a friend on budgeting techniques or teaching your kids about saving and investing, spreading financial literacy is beneficial for everyone. It’s like passing down a cherished family recipe that can help others create their own financial feasts.

Chapter 7: The Dessert – Celebrating Financial Milestones

Savoring the Sweet Success

In our culinary adventure of finances, reaching a milestone is like enjoying a well-deserved dessert. Whether it’s paying off a debt, reaching a savings goal, or making a successful investment, take the time to appreciate these achievements. Celebrating these moments boosts your motivation and sets a positive tone for future financial endeavors.

Creating a Tradition of Rewards

Just as some desserts become family traditions, establish rewarding traditions for your financial milestones. This could be a small treat, a special outing, or even just a moment of reflection and gratitude. These celebrations are reminders of your hard work and dedication to financial wellness.

Chapter 8: Cleaning Up – Avoiding and Correcting Mistakes

Learning from Spills and Splatters

In the kitchen, spills are inevitable, just as financial missteps are in life. The key is not to dwell on these mistakes, but to learn from them. Did an unexpected expense catch you off guard? Perhaps it’s time to revisit your emergency fund strategy. Overspent on luxuries? Consider revising your discretionary spending habits.

Keeping Your Financial Kitchen Clean

Regular maintenance is crucial, both in cooking and finances. Review your financial plan periodically, decluttering and reorganizing as necessary. This could involve reassessing your budget, revising your investment strategies, or simply updating your financial records. A clean and organized financial plan is more manageable and less stressful.

Chapter 9: The Ever-Evolving Menu – Adapting to Change

Embracing New Flavors

Just as food trends evolve, so do financial landscapes. Be open to incorporating new financial products, technologies, or strategies into your plan. Maybe it’s exploring a new investment opportunity, or using a novel budgeting app. Staying adaptable and informed keeps your financial strategy fresh and effective.

Seasonal Adjustments

Just like seasonal ingredients enhance a dish, understanding the seasonal nature of finances can be beneficial. This might involve adjusting your budget to account for holiday spending, or capitalizing on end-of-financial-year tax strategies. Recognizing and adapting to these financial seasons can lead to more fruitful outcomes.